How Visor Makes Big Decisions on Little Data – And Wins

Making business decisions is like jumping into a painting.

Seriously, stay with me here.

Imagine I showed you a painting and told you that you could jump into it. It’s a beautiful painting of the sun setting over the ocean. But there’s a big chunk missing—something blurry or painted out. Would you want to jump in right now? That depends. Is that missing section the deck of a ship? A beach? An oil rig? Just empty water? Knowing whether you’d land safely on a cruise ship or find yourself swimming with sharks makes a big difference in your decision. But with missing data, it’s hard to make the call.

Back to reality.

When it comes to making product decisions, it’s long been clear that data is preferable to relying on gut instincts. Accurately collected and well-interpreted data separates intentional, savvy product decisions from shooting in the dark. But while knowing you need data is one thing, collecting it – and then making sense of it – is another challenge. And when you’re working at an early-stage company like Visor, there’s a frustrating reality: you’ll never have quite enough data to create the whole picture. Just like that painting, missing information can make a huge difference in the decisions we make as a company.

Nevertheless, making important decisions with the limited data we have is exactly what I do.

My name is Dmitriy Redkin, and I’m a Product Manager at Visor. I listen to our customers, analyze the market, and collaborate with our design and engineering teams to craft a valuable, differentiated, and delightful product that helps our users manage their work better than their existing systems. I’m the guy on the team who looks at incomplete paintings and asks the big questions about what’s in that unknown space. I analyze the edges of the problem, fill in as much information as possible, and determine our next steps.

Here’s my take on how Visor makes product decisions – even when the data painting isn’t quite filled in.

Making a Little Data Work for a PLG Startup

To be data-informed at Visor, we first have to understand what it means to be data-informed—especially given the specific challenges startups like ours face. Unlike massive enterprises with large customer bases and years of data at their fingertips, startups operate in an environment where information is limited. That means we need to adapt to making decisions from very small samples rather than performing analysis across hundreds, thousands, or millions of observations

For example, we track data across all aspects of a user’s journey. Starting with our onboarding funnel, we analyze drop-off rates: Does introducing a new page with a few onboarding questions increase churn? Or does it help guide users more effectively? We also track activation metrics—such as whether users hit key milestones like sharing with a team member within their first seven days—and correlate those actions with long-term engagement. Every feature we ship is tied back to data, ensuring our quarterly goals align with our product improvements.

Watch me walk through the Visor app!

Being a product-led growth (PLG) company presents a unique challenge: we don’t have traditional sales calls where customers make direct feature requests. Instead, we have to be resourceful in generating insights.

One way we do this is by tracking user searches. What are users looking for in our knowledge base? We bucket those search queries and correlate them with user types to identify which features are in the highest demand. Understanding who needs what most frequently helps us shape our roadmap.

The best illustration of this is our biggest recent change.

Pricing and Packaging: A Case Study in Data-Informed Decisions

We recently tackled our biggest project in the last 12 months: restructuring Visor’s pricing and packaging (the internal codename was “PnP”).

For the three years after we began charging for our product, we were in learning mode. We were keeping our prices low in an effort to gain as much data as possible from our users – we wanted to know everything we possibly could about how they engaged with our product before and after a sale. This was a way to paint in that picture and work towards shrinking the blank areas as much as possible. It’s a lot easier to decide to jump into a painting when you can see the outline of a shoreline!

But as we identified what types of features drove the most value (and discovered we didn’t have a billing model that valued those features), we realized that we needed a more intentional pricing model that balanced fairness with business growth. Our goal? Increase both the rate of learning and revenue growth.

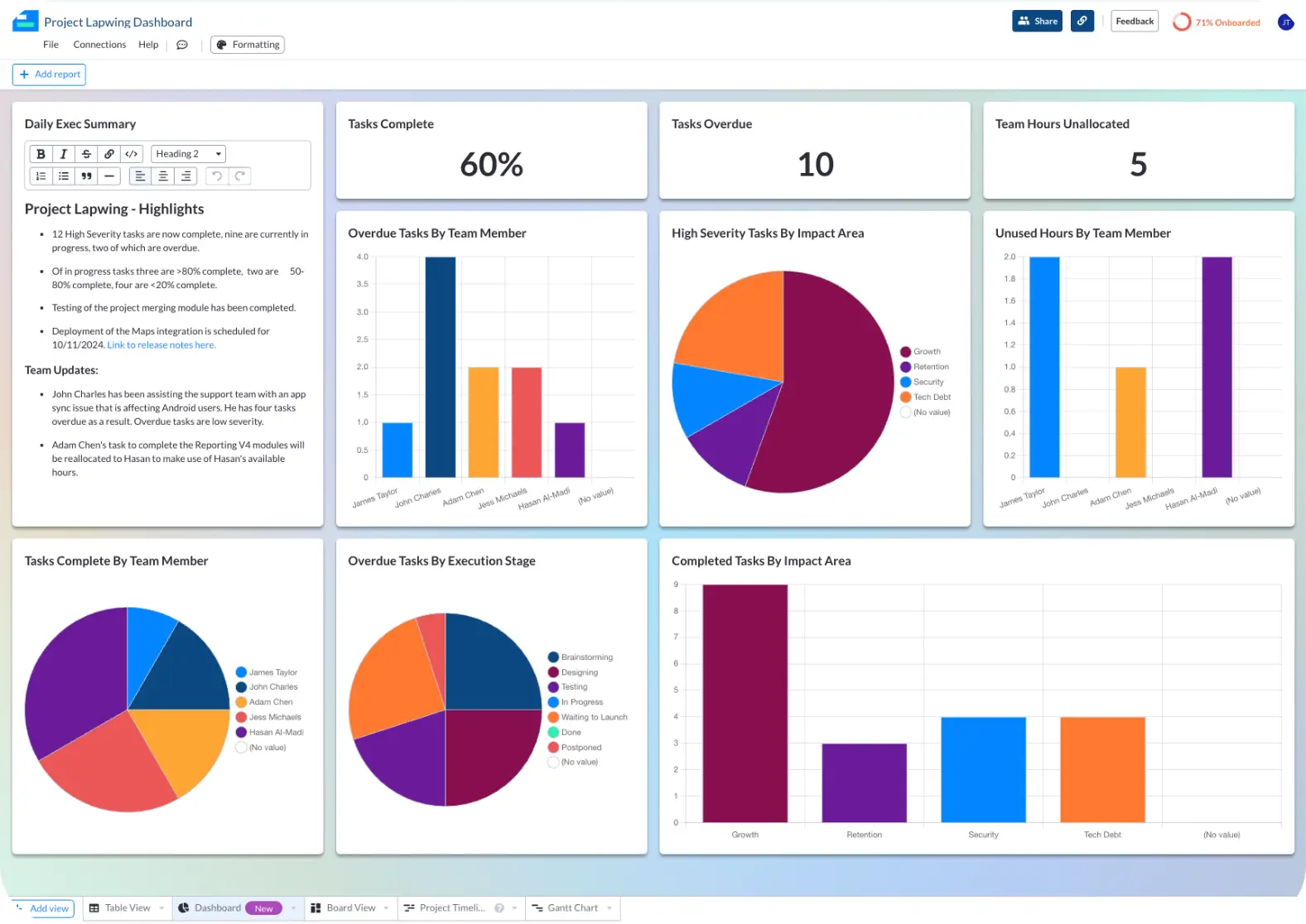

A dashboard in Visor featuring integrated multi-app data

The fact that we waited three years to iterate on our pricing model was probably too long, in retrospect. But one major change we made is pivoting from a “Freemium” model to a reverse trial model. In a reverse trial, customers get to try a premium plan for a period of time and then revert to the free plan. Prior to this, new users began on a free plan and had the option of upgrading at any time.

This change was a delicate balancing act – demonstrating the benefits of premium features without losing users to drop-off. To succeed, we coordinated across design, business development, and marketing, ensuring data from all areas informed our decisions.

One of the key insights we leveraged was the existence of two distinct user types: individuals who needed budget-friendly plans to work solo and teams that required robust collaboration tools. Previously, our higher plans simply differed in terms of the quantities of their capabilities. Otherwise, all plans included roughly the same features.

We realized we needed to differentiate plans by functionality, not just quantity. In doing so, we were able to use the plans we offered to better-fit the needs of specific common personas.

For example, we get a substantial number of solo-users who need the basic features without collaboration capabilities (and expect a plan that’s affordable for them). We designed a “Starter” plan just for them, including everything they needed (and nothing they didn’t) at a value-conscious rate. We packaged the collaboration-oriented features in a new “Team” plan, which serves the customers who prioritize collaboration and control.

Since making these changes, we’ve seen a dramatic increase in business performance – higher conversion rates, more annual pre-payments, and customers opting for the highest-value plan we offer with more confidence. Most importantly, we’re seeing customers start on the Starter plan and upgrade to the Team plan as their team grows.

But where did we get those insights in the first place to change how we think about our plans?

Visor’s Data Edge

We may not have had all the information going into our PnP overhaul, but we certainly weren’t flying blind either. Even though we don’t have the massive datasets of enterprise companies, we make every data point count. We use a combination of factors to help us make decisions from the most informed possible place.

The first is appealing to a goddess.

Our proprietary telemetry platform is called Athena. Athena is powered by a combination of Amazon Redshift as the data lake, proprietary JavaScript modules to capture user interactions and application performance monitoring data, and Metabase as the analysis layer. Athena helps us create graphs and dashboards about the health of our customers and our systems. It’s very powerful!

We also gain visibility via apps such as Fullstory, which we use to bridge the gap between quantitative data and live user experiences. Fullstory allows us to watch how our users interact with the product, so we can connect their clicks, scrolls, and feedback into a cohesive story.

Last but not least, we’ve extracted a ton of value out of Salesforce. We use Salesforce as a key platform in our growth engine – which isn’t as traditional for a PLG company. But it centralizes information about users, support tickets, and user milestones that drive other parts of our growth stack.

Then there’s the dogfood.

Like any great SaaS, we use our own product to improve itself. Our marketing and engineering teams manage large projects in Visor, integrating with tools like Jira and Asana. Because we rely on Visor daily, we quickly notice friction points and address them. Visor itself helps all of these different points of data come together.

This all comes together in some impressive ways.

We’ve made Visor better overall as we make changes to our system because we treated that feedback as a new datapoint to collect. We used Athena to understand and categorize user behavior into two personas: solo power-users and collaborative oversight users. Athena gave us the data we needed to make decisions about how different user groups interacted with the product, so that we could make plans that gave them the features they really needed. And don’t think quantities went away entirely; the data we processed also gave us insight into how much of a given ability different user personas needed.

So we used great tools, updated PnP, and it was all smooth sailing in that ocean painting, right?

Well, mostly. We did hit some friction – but we had our data to help us figure it out.

Beyond Initiation: Data-Informed Problem Solving

It’s more or less impossible to predict every single problem you might have with a new rollout. This is true even when you have lots of data, let alone in limited amounts. Luckily, because we’re all about creating internal systems to maximize the value of what information we have, we’re able to work quickly to spot issues and avert disasters.

For the PnP rollout, the issue we ran into was a paywall problem.

We expected our users to hit frequently-distributed paywalls, prompting them to upgrade. Much of our early system was built around that assumption, and it felt like a safe one. But when we analyzed the data post-launch, we found that users weren’t triggering paywalls as often as anticipated. They were using the features, but they weren’t clicking the right elements to set off an actual paywall popup.

This was a problem. Our funnel depended on those upgrade triggers. We had to do some digging.

Fullstory gave us a snapshot of how users were truly behaving inside the app. Salesforce showed us additional information on who these users were and what they’d cared about in the past. And Athena, of course, had all the depth of information to compare the current user actions against previous ones.

Because of our system we quickly adapted, adding analytics layers to detect where and when users actually engaged with premium features. We also incorporated in-app messaging and email sequences to make sure users understood how their access to Visor would change when their trial expired.

PnP took about six months to conceptualize and two months to build. That’s including everything from pricing structures to infrastructure, entitlement permissions, and even marketing. The effort paid off dramatically, with month-on-month growth figures we’ve never seen before.

It’s been a surprisingly smooth process overall, and I believe that’s because of the effort we’ve put into deeply understanding our end user and making the most out of all the data we have.

Building Visor’s Roadmap

With our PnP changes already showing success, we’re excited for what’s ahead. We’re seeing larger purchases, longer commitments, and a growing number of users upgrading from Starter to Team plans—validating our approach.

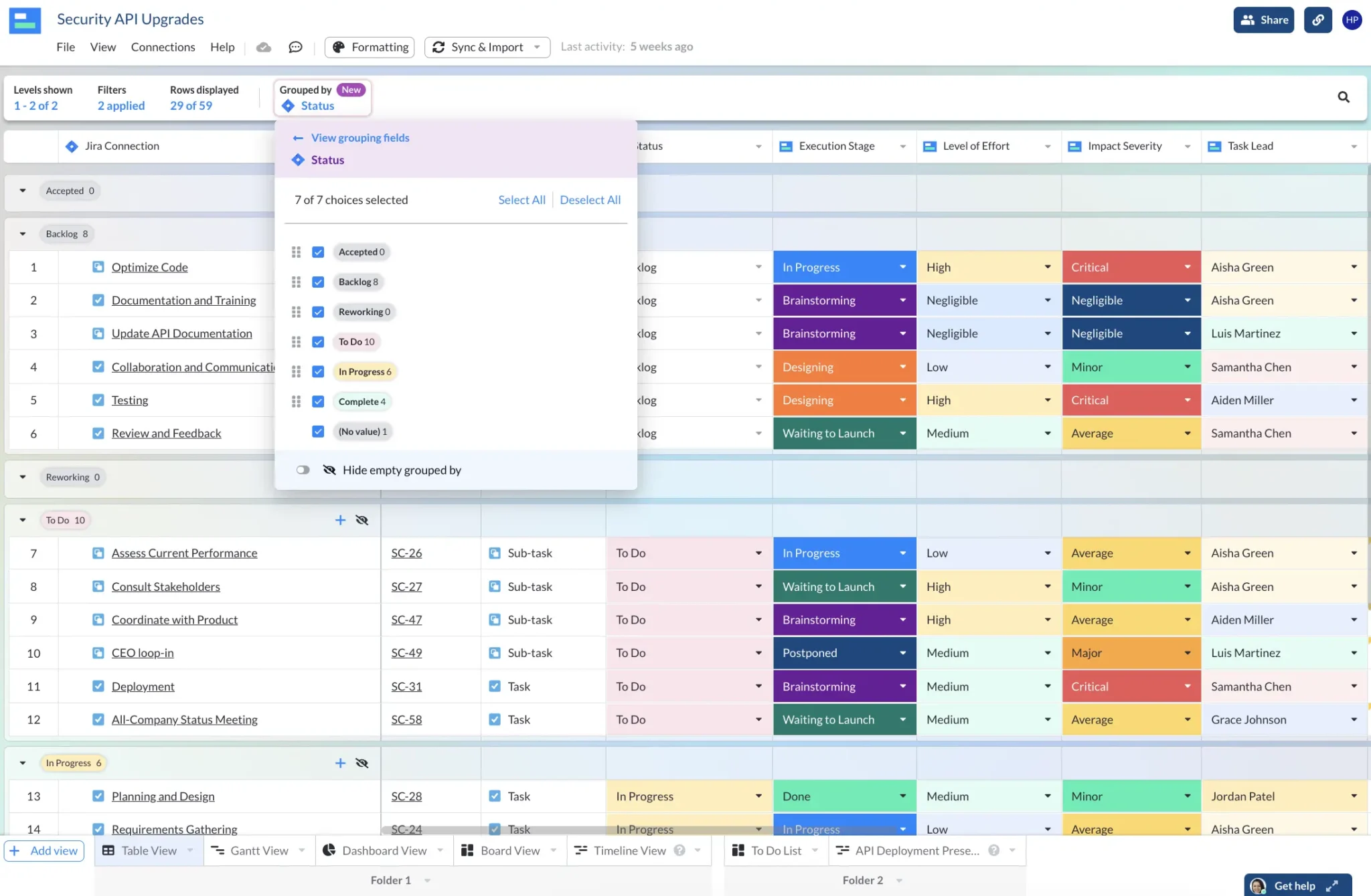

A recent launch – grid grouping

Looking forward, we’re focusing on several new initiatives, but here’s the two that have me the most excited:

- Advanced dependency functionality: A new feature to help PMs answer complex stakeholder questions.

- Ambient AI: AI that is subtly present, always working in the background to optimize and personalize our product experience without demanding user attention. The first example is AI that configures a user’s account based on what we know about their persona and use case.

Visor thrives on making smart decisions with limited data. Our PnP overhaul is a testament to our ability to extract meaningful insights, pivot quickly, and drive real business growth.

As we continue to refine our strategies and expand our capabilities, one thing remains clear: even when the painting is incomplete, we know how to make the right call – and land right where we want to be.