What Smartsheet Customers Need to Know About The Private Equity Takeover

After a summer of rumors, it’s finally confirmed: Blackstone and Vista Equity Partners will acquire Smartsheet for over $8 billion.

For customers, that means big changes are coming.

While you might not notice the changes on a day-to-day basis, in the long term they’ll become very apparent. If you’re a Smartsheet customer, now is the time to start looking into alternative solutions as a backup, because some of these changes might disrupt your work (and they will definitely impact your bill).

Trust me on this one: I’ve seen it from the inside.

Before I founded Visor, I worked at Insight Partners, one of Smartsheet’s former investors and a peer to Vista. My own firm put together similarly massive multi-billion dollar acquisitions and take-privates. This is a playbook I know very well. But while my team focused on growth and expansion that would lead to R&D investments and hiring top talent, Vista had a reputation for being ruthlessly effective at extracting value via other means.

I’m going to break down what Vista’s take-private playbook looks like, what current Smartsheet users can expect from the acquisition, and what you might want to consider doing next.

If the potential changes around Smartsheet’s acquisition have left you looking for an alternative app to visualize your projects and portfolios then you should try Visor for free.

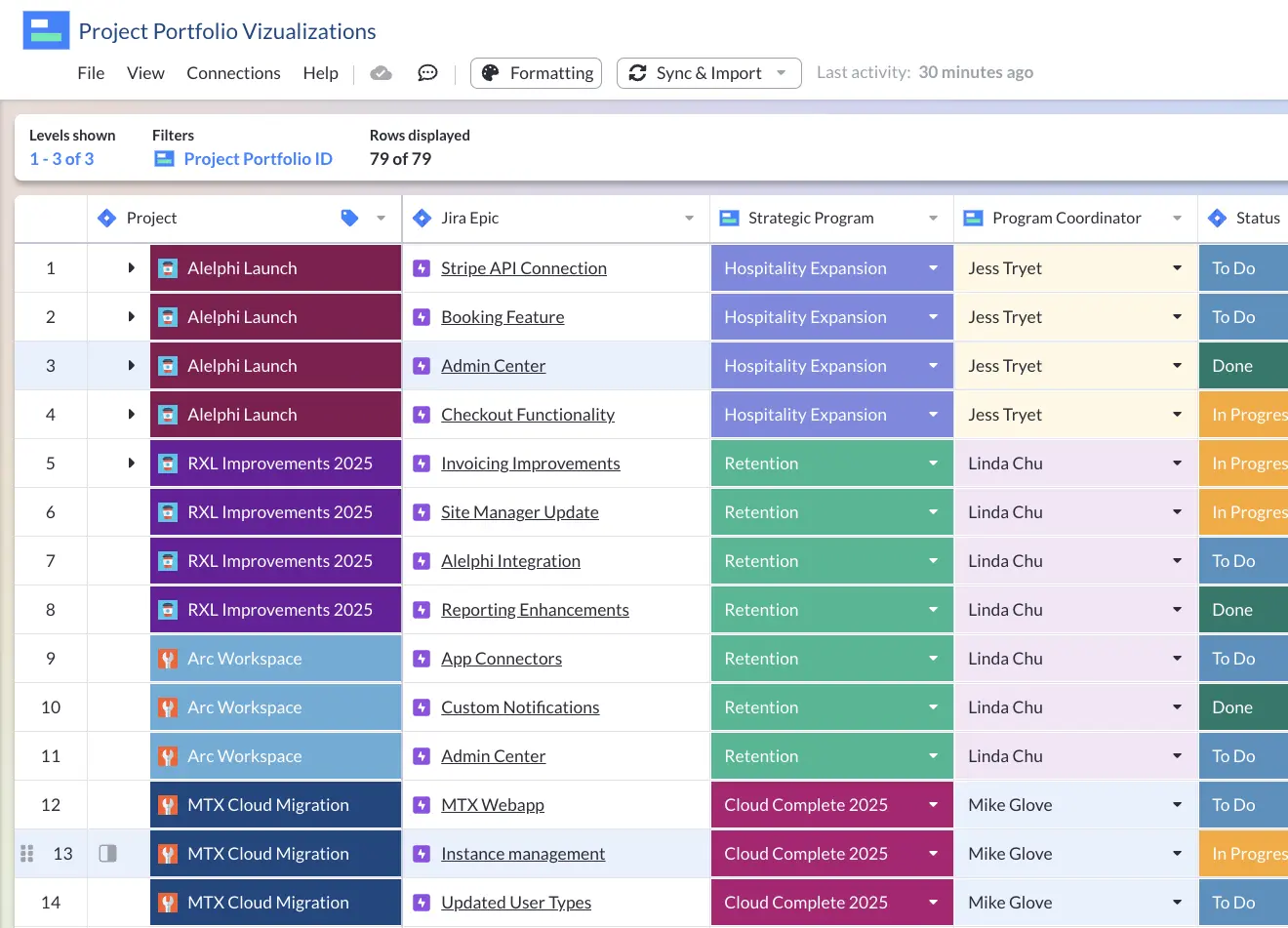

A Table view in Visor, using data from Jira:

The Smartsheet Deal and How Vista Operates

This deal is one of the largest “take-privates” of the year. But what is a take-private?

A “take-private” is when a buyer purchases substantially all of the shares of a publicly traded business, changing the company from a publicly-held company to a privately-held company. That means the buyer has complete control over the business and can stop making public filings of their financials. Take-privates are pretty common, but this one is noteworthy for anyone in the Project or Product Management space.

Why would Vista want to take Smartsheet private? Simple: they want to take control of the business, change things so it becomes more valuable, and then sell it down the line for more money. If you’ve ever heard about real estate “flipping,” it’s a similar concept: buy the place, spruce it up so it seems more valuable, and sell it to the next buyer.

Vista specializes in take-privates of software companies. Their playbook involves bringing in new executives aligned with their own objectives. These new executives then try to increase profit by a combination of cost-cutting, price increases (or “shrinkflation”), upselling existing customers more products, and rapid customer expansion.

I’ve even seen some private equity firms go so far as to find new ways to “balance” customer satisfaction, with the idea being that a high customer satisfaction score is actually an untapped resource. So the plan becomes increasing profitability by making the product just a little bit less good or a little more expensive… often, both! That’s a pretty extreme example, and it certainly isn’t what all firms like Vista do, but it puts in perspective the changes that are about to happen at Smartsheet.

Vista is a very savvy company that is exceptionally good at what they do. In fact, they specialize in working only with enterprise software companies. They’re very successful, but their success – to some extent – comes at the cost of customer satisfaction. We’ve seen that happen before with some of Vista’s other acquisitions, but I’ll get into that more later.

It reminds me of when the “Oreo cookie bubble” burst. Growing up, my friend’s mom worked as an expert taster for Nabisco, the maker of Oreo cookies. The lab kept giving her new Oreo cookies and asking if she could tell a difference. It turned out, they were slowly replacing the creme filling with more and more air puffing to reduce the amount they spent on creme, thereby raising profit margins. A Vista take-private means Smartsheet customers may be in for a similar experience.

Previous Vista Take-Privates

I’d urge current Smartsheet users to consider what happened after Vista acquired MindBody. MindBody is a scheduling app for various wellness and fitness related services like yoga studios. Vista took MindBody private in 2018 for $1.9 billion.

Then they followed that exact playbook I outlined. They worked on operational efficiencies, creating changes on internal teams and altering the way the company had previously worked. They also purchased several other similar companies, like ClassPass. Then they cut features and raised prices for the end users.

MindBody was one of the first in the wellness scheduling space, and they stayed ahead of their competition by being very innovative. But after Vista took them private, much of that innovation slowed down. Because of the roll-ups Vista did in the space, reducing the amount of competition, they didn’t need to compete as hard.

User reviews plummeted for MindBody once this was over. But by then, there weren’t many alternatives in the space, so a lot of users didn’t feel that they had a choice.

“I use a service for my business. I was told I could downgrade at any time. I have tried to downgrade for 2 months and no one will respond to me. They keep saying it’s another department who needs to take care of it. I was lied to.”

“I could not use any features related to Flex nor did I have any way to cancel the membership since it can only be canceled on the website version (not on the phone app). As far as I am concerned, this is fraud. I want my money refunded AND I do not want any recurring charges.”

What happened with MindBody isn’t necessarily going to happen with Smartsheet. But it’s an example of how Vista could choose to operate post-acquisition, and it’s important to keep in mind.

Every situation is different, so it’s important to understand what’s happened and what’s going to change for Smartsheet users. That means you have to ask: why Smartsheet?

Where Smartsheet Went Right

Smartsheet is a really sophisticated, mature, and widely known tool, and all three of those things benefit customers.

Being sophisticated means you’re rarely going to run into a use case or scenario where the product can’t help. Since it was founded in 2005, Smartsheet has had a lot of time to improve the product.

At the time of writing, Smartsheet has grown to over 3,000 employees and made over $900 million in revenue in the last year. That’s an impressive growth story for the not-quite-20 year old company!

Smartsheet’s long-established brand also makes it easier to justify bringing the tool into your company and asking everyone to get onboard. Most people have at least heard of it, and many people have worked with it in the past.

But what Smartsheet has done really well is that they focused on creating a better version of a tool everyone already understood: spreadsheets. Project management and spreadsheets go hand in hand. When you use Smartsheet, it gives you that signature flexibility you’ve come to expect from a spreadsheet. Then, when you share it with other collaborators, they find it very intuitive to understand, because most people have been using spreadsheets for their entire professional careers – maybe even before!

Because Smartsheet gives you something that’s completely familiar, the tool gets out of the way and you can get your work done. That’s a really important quality that stands out in the market.

While it hasn’t always been the leader of the market, it makes sense why so many people choose Smartsheet. But some of these factors may be about to change for Smartsheet customers.

What’s Changing, and What To Expect

As I said previously, the people at Vista are really good at what they do. They form deeply detailed plans of how they expect to profit from a purchase, they buy it, and then they get to work.

One way to think about a Vista take-private is this: they’re extracting more value from the same asset. If you want to get cynical, you might say Vista expects to extract more value from you, the Smartsheet customer.

They see an opportunity within Smartsheet’s business to make even more money than the company had been making. That money is going to come from one of three places: cut costs, new customers, and existing customers paying more.

From a cost reduction perspective, that often means reduction in R&D budgets. That money is then reallocated to sales and marketing in order to grow revenue. If something doesn’t bring in more revenue, it’s on the chopping block. For example, you may find that customer support becomes less responsive (or less fluent in speaking your language) than before. Or you may find that bugs take longer to get fixed.

Often, Vista will do something called a roll-up, where they look for other alternative brands to the one they’ve purchased and acquire them. If that other brand had a competing product, that means one less competitor standing in the way of price increases. If that other brand had a complementary product, that means there’s another product your Smartsheet salesperson is going to try to add to your bill. This is exactly what happened with MindBody and ClassPass.

Red Flags for Smartsheet Users

If you’re a Smartsheet user who is reading this and getting nervous, that’s really understandable. I’m not trying to scare you, but I do hope that you take this information as a bit of an early warning. Everything might work out fine, and you might not notice any changes at all. But you also might start seeing red flags over time. Here’s what to start looking for:

New glitches

One of the easiest ways to tell that something is changing internally after an app is acquired is an uptick in product issues. That could include an introduction of glitches, issues, or downtime. It may be hard to put your finger on, but you may start to see the product drop in quality.

This is a great early indicator that app quality is going to go down across the board, because it’s a hint that the team behind the app is working differently. Broadly speaking, these issues stem from a team that is a little distracted by bigger organizational shifts. When take-privates occur, you often see changes in ownership and leadership. Vista is going to bring in their own people to change how the teams at Smartsheet are managed. But when those changes happen, it can be distracting for the people working at the company, and they might start dropping balls.

The Vista team is very good at making this a smooth process, so hopefully it won’t show to the end user. But cybersecurity breaches or lost data aren’t beyond the realm of possibility when there’s so much change coming.

Intense marketing

The second big red flag you should expect is when it feels like you’re suddenly being sold to or marketed to more aggressively. That’s a core part of the Vista playbook: to sell and market much harder.

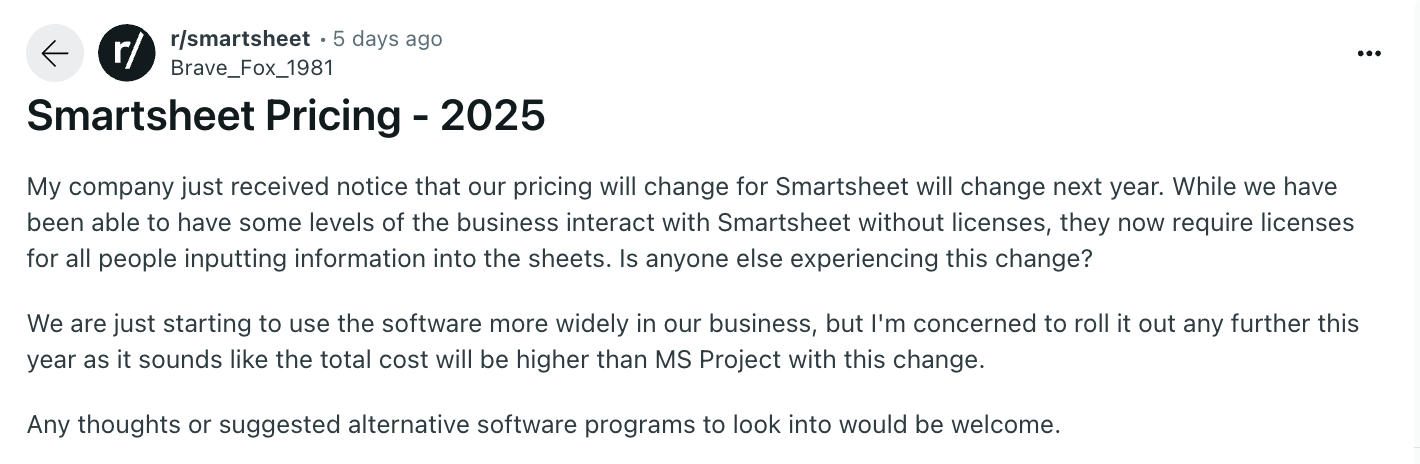

If you’ve never heard from a Smartsheet sales rep before, get ready, because your phone is about to start ringing off the hook with somebody trying to sell or upsell you new items, or to try and get you to buy new licenses. We’re already starting to hear about this happening with Smartsheet users.

Once again, Vista’s goal is to increase the value of Smartsheet. You are the person they’re expecting to help them do that. Whether you’re paying more for what you’ve got or you’re paying more to get new things, expect to feel a little bit more pressure to buy or pay more.

Slowed innovation

The last red flag I would mention is that the product innovation might slow down. You’ll see less frequent product updates, promised features languishing on an untouched roadmap, or needed fixes getting band-aid solutions.

Smartsheet is already very mature and Vista is not necessarily known for investing in companies at this stage and then deeply investing in research and development to improve the product. They typically find software companies that have a dominant position in the market with the product they already have. They feel like they can extract more value by leaning in on sales and marketing, without needing much additional R&D.

Overall, you can expect to receive “less for more” as Smartsheet changes their pricing structure, stops introducing new features, and takes away formerly free or included elements of the product.

Other Options for Smartsheet Users

If you’re currently using Smartsheet, you should start considering what you might want to fall back on if you see those red flags. You might want to think about whether you want to stick around to find out. Now could be a great time to explore what other options are out there by companies trying harder to earn your business.

If you’re looking for other project management solutions, you might consider options like Jira, Asana, or even Airtable. These are commonly used tools for PMs, and are unlikely to suffer from a roll-up any time soon. If you’re paying for the expensive Jira/Smartsheet add-on, you may even have some of your data in Jira already.

If you need a true spreadsheet, you could try alternatives like Google Sheets or Microsoft Excel. Both are household names for a good reason, though they’re both missing a lot of the Smartsheet functionality.

Regardless, the best path forward is to spend time now thinking about what you really need, and what other features might be on your wishlist.

There are a lot of current Smartsheet users I’d describe as overserved. In other words, Smartsheet offers so many features that most users don’t need, so you end up caught in the frustration of dealing with the tool itself. That’s annoying, especially as the cost is high and will continue to grow. By continuing with Smartsheet, it’s going to feel like you’re getting charged for things that you don’t need or don’t use.

If you’re a current Smartsheet user who is worried about these changes, or even one who feels that Smartsheet isn’t meeting your needs as well as it could, you should also take a look at Visor.

For anyone who needs to manage projects, especially if you already feel at home in spreadsheets, you’ll find that Visor is a spreadsheet-first project management tool that also offers a wide variety of other visualizations and tools to help improve team collaboration.

Visor’s extraordinarily powerful two-way integrations make it fit seamlessly into companies that use other tools like Jira, Asana, and Salesforce. If your team already uses Jira and you’re using Smartsheet on top of it, you’re probably paying a ton for the Smartsheet Jira connector that has substantial limitations and isn’t great. But you’ll find a higher-quality Jira integration included out of the box with Visor, so you’re going to see cost savings by making the switch.

We’re already beginning to see this.

The collaborative nature of Visor is also more fulsome than Smartsheet’s; Visor’s updates are always real-time, unlike the workarounds you need to make Smartsheet as immediate. In Visor, you can even share links that grant anyone access to view what you’re working on, great for sharing via Slack or email. It allows for much freer and faster information flow and collaboration options than Smartsheet, while still providing that spreadsheet flexibility.

| Smartsheet (Pro Plan) | Visor (Free Plan) | |

|---|---|---|

| Monthly cost | $12 Per User | Free |

| G2 Review Score | ★★★★☆ | ★★★★★ |

| Table/Spreadsheet View | ✔ | ✔ |

| Timeline Views | X | ✔ |

| Dashboard Views | ✔ | ✔ |

| Gantt Chart Views | ✔ | ✔ |

| Kanban Board Views | ✔ | ✔ |

| # of View-Only Users | Unlimited | Unlimited |

| Custom (HEX) Color Coding | X | ✔ |

| Easy, Free Setup For All Integrations | X | ✔ |

| Jira Two-Way Integration* | X | ✔ |

| Salesforce Two-Way Integration* | X | ✔ |

| Asana Two-way Integration* | X | ✔ |

| Data Stays In Sync Across All View Types | ✔ | ✔ |

| Embed Views In Other Apps | ✔ | ✔ |

| Maximum Widgets Per Dashboard | 10 | Unlimited |

| Formulas | ✔ | X |

| Advanced Field Protection | X | ✔ |

| Chat & Email Support | X | ✔ |

| Technical & Engineer Support | X | ✔ |

Smartsheet Isn’t Going Away, but It’s About To Change

A big take-private like this doesn’t mean that the app you love is doomed. But it does mean that big changes are coming, and a lot of those changes are going to impact the customers: you.

If you’re a Smartsheet user, now is the time to assess if this is still the tool you’re most satisfied using, and if you’re really up for the changes you’ll soon see.

While Smartsheet is a big, well-established choice, it might be worth looking at newer, sleeker options. These new tools aren’t quite as big yet, but they’re moving in exciting directions much faster, and they have a team that’s especially eager to make sure you have the best experience possible.

Visor offers a no-commitment 14-day free trial, so try it out today.